tax abatement definition accounting

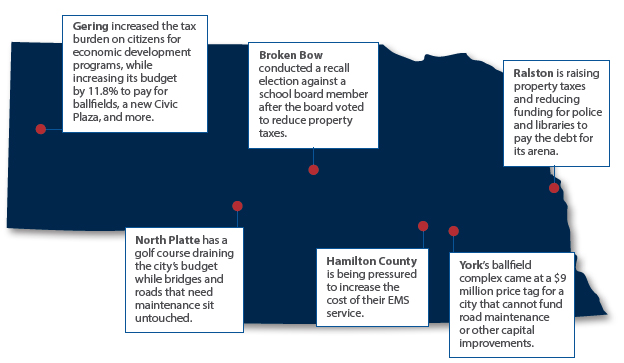

We have a specific concern that. Tax abatement on property is a major savings.

Non Profit Accounting Service And Advice El Paso Tx Marcfair

Tax abatements are reductions in the amount of taxes an individual or company is responsible for paying.

. The development is eligible for a 10-year property tax abatement. What Does Abatement Mean. In broad terms an abatement is any reduction of an individual or corporations tax liability.

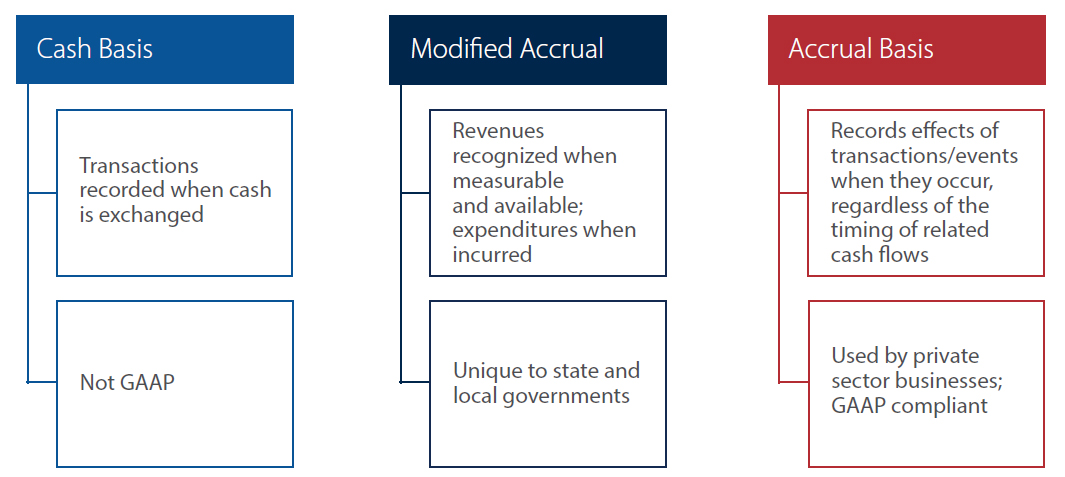

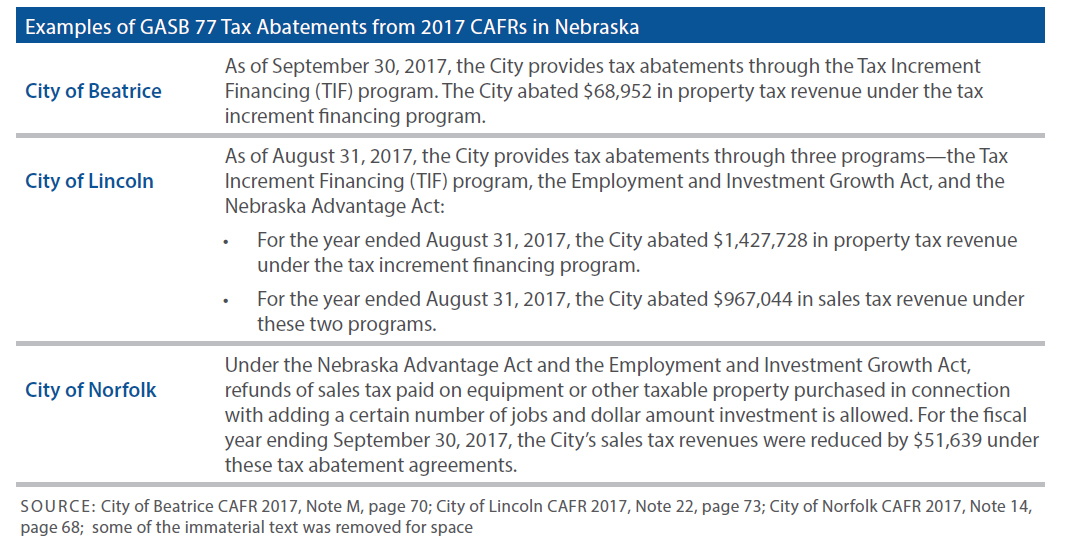

Specifically gasb statement 77 requires governmental units to disclose tax abatement information related to 1 tax abatement agreements that are entered into by a reporting government a government issuing a financial statement and 2 those that are entered into by other governmental entities eg by a county in which a reporting city is. IRS Definition of IRS Penalty Abatement You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control. Tax breaks for research and development depreciation and more.

These perks allow a business to focus on the future rather than trying to survive in the present. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. Property tax abatements are offered by some cities in the form of programs that reduce or eliminate property tax payments on qualifying property for a set amount of time to be determined on an individual case basis.

A sales tax holiday is another instance of tax abatement. Instructions to preparer. Abatement is a measure that alleviates or reduces a burden.

Automated Substitute for Return ASFR - is an automated non-filer delinquency program assessment using procedures under IRC 6020 b Execution of Return by Secretary when a taxpayer fails to file a Form 1040 return required by any Internal Revenue law or regulation. Abatement can be defined as a reduction in the tax rate or tax liability that is applied to an individual or a business entity. Tax Abatement A reduction of taxes for a certain period or in exchange for conducting a certain task.

The term abatement refers to a situation where an economic burden is reduced. The Governmental Accounting Standards Board GASB Statement 77 Tax Abatement Disclosures is effective for years ended December 31 2016 and after. Whether revitalization efforts will ultimately prove successful is a big question mark.

The tax abatement is an incentive to encourage people to redevelop and move into these areas. The term commonly refers to tax incentives that attempt to promote investments that boost economic growth or provide other social benefits. Example of Abatement The major and most profound examples of abatement come in the case of property taxes however in certain cases the word abatement is also used to refer some overdue debt.

An amount by which a tax is reduced Learn More About tax abatement Dictionary Entries Near tax abatement taxa tax abatement Taxaceae See More. It is a procedure that decreases the amount owed or imposed in a certain transaction. A reduction or decreaseLocal governments sometimes offer tax abatements to new businesses in order to attract them to the areaCommercial leases usually have clauses denying rent abatement if the leased property is partially destroyed and.

These motivations are common to in the business world. Tax abatement means a tax incentive given to business for the purpose of spending it in another way. A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement.

One or more governments promise to forgo tax revenues to which they are otherwise entitled AND. Most owners of houses will be required to pay property taxes that are commonly from 1 to 3 of the value of the house every year. It represents part of the ongoing cost of owning a home.

Defines a tax abatement as a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which. This annual expense does not disappear when the mortgage is completely paid. This disclosure is required only if the programs and policies affects taxes collected by the citycountydistrict.

Proposed Statement of Governmental Accounting Standards Regarding Tax Abatement Disclosures the Proposal Would require governments that are subject to tax abatement agreements to make certain disclosures. Definition of tax abatement. Tax abatement Tax Account Analysis and Recovery Services Tax Account Number Tax accounting Tax Accounting Risk Advisory Service Tax Accounting System Tax Administration Act Tax Administration Advisory Services Tax Administration Bill Tax Administration Data Base Tax Administration Reform Programme Tax Administration Services Department.

Tax abatement noun C or U TAX FINANCE PROPERTY uk us a reduction in the amount of tax that a business would normally have to pay in a particular situation for example to encourage investment. More from HR Block Penalty abatement removal is available for certain penalties under certain circumstances. Any agreements that contribute to economic development or otherwise.

Without tax abatement I will never get the loans to finance the project.

What Is A Deferred Tax Liability Community Tax

Top Rated Tax Resolution Firm Tax Help Polston Tax

The Basics Of Double Entry Accounting Community Tax

The Basics Of Double Entry Accounting Community Tax

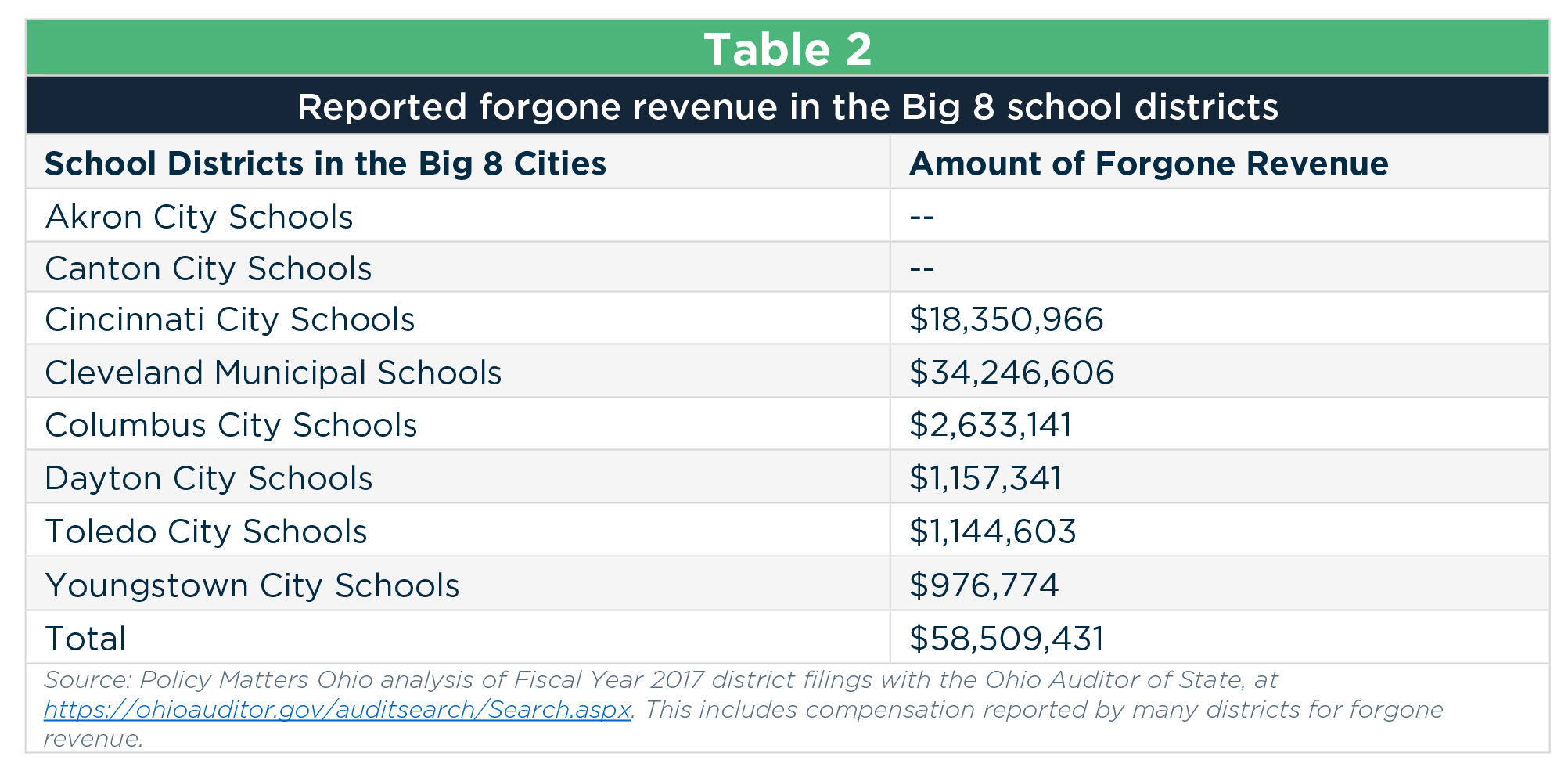

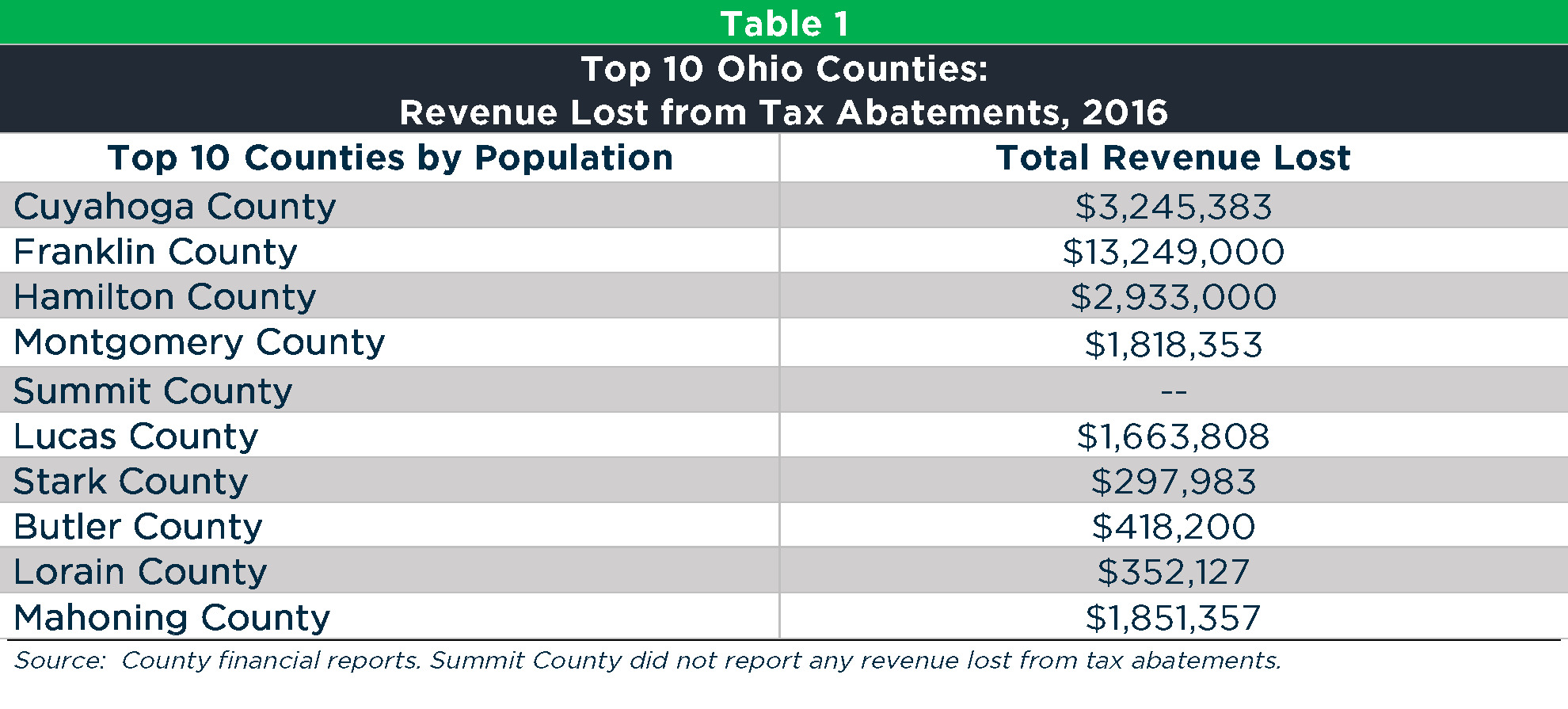

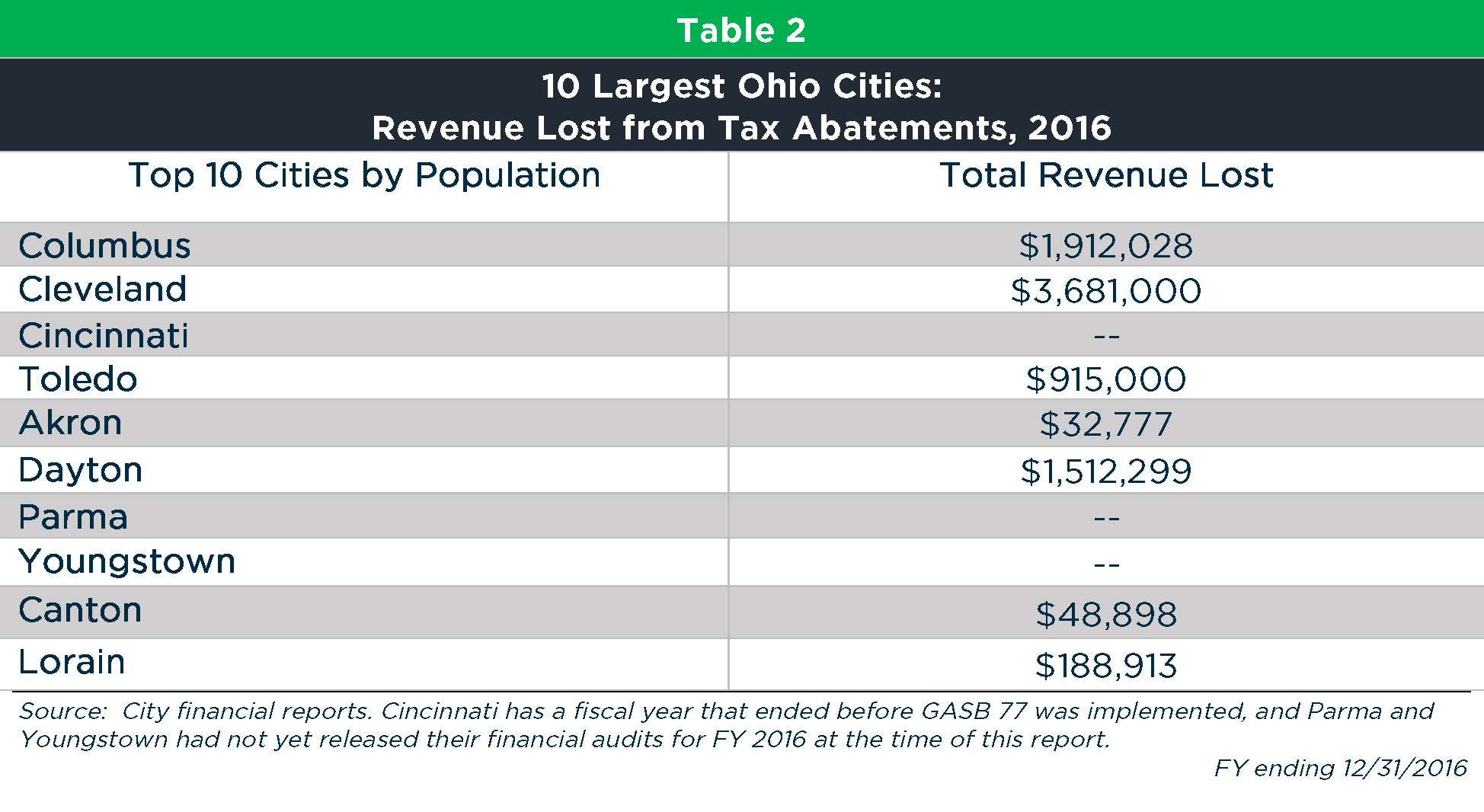

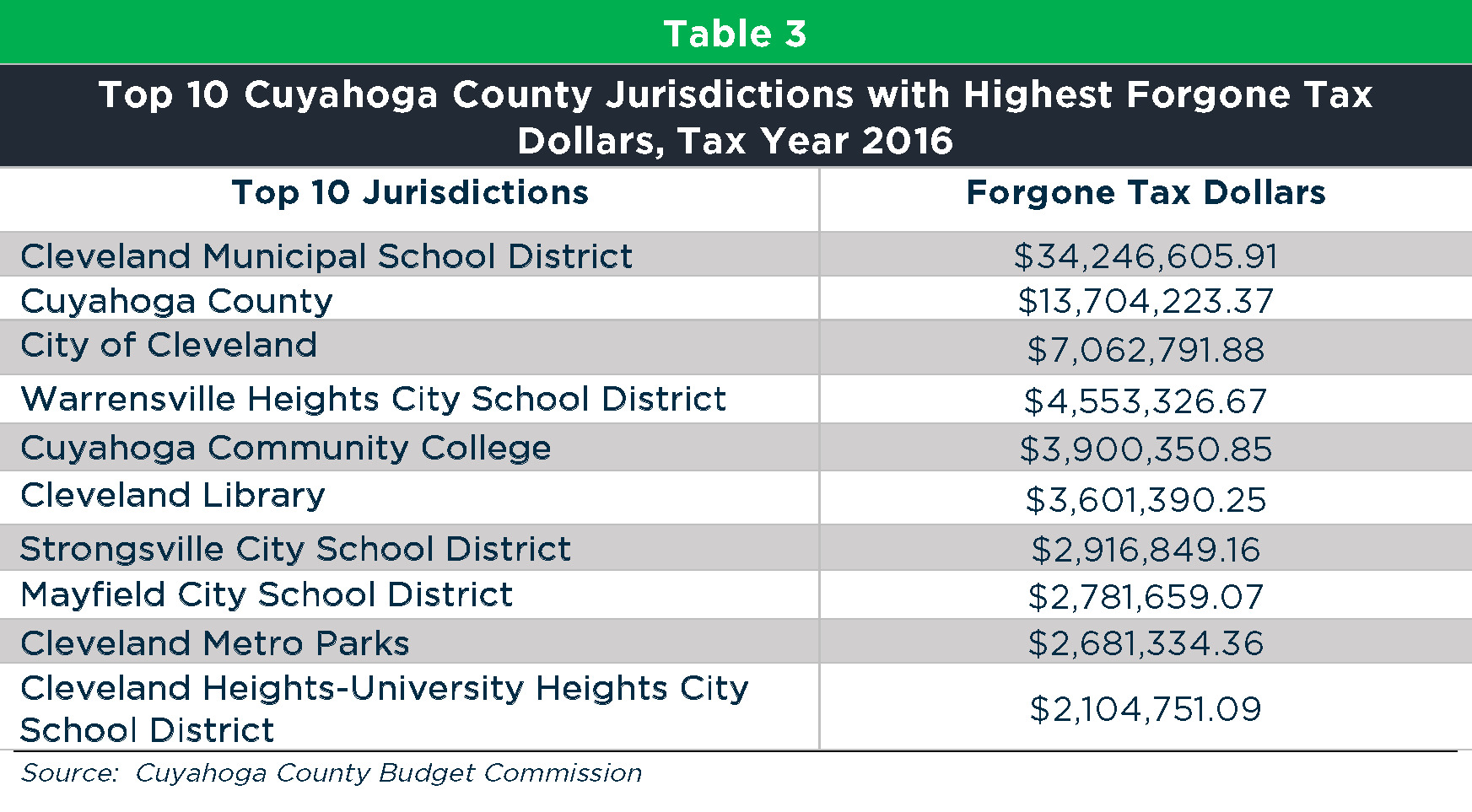

Tax Abatements Cost Ohio Schools At Least 125 Million

Pin On Free Billing Statement Templates

Local Tax Abatement In Ohio A Flash Of Transparency

Form 5471 Top 6 Reporting Challenges Expat Tax Professionals

Are You Unsure What Expenses Are Deductible For You Business This Infographic List The Most Business Expense Small Business Bookkeeping Bookkeeping Business

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Local Tax Abatement In Ohio A Flash Of Transparency

What Is The Accounting Cycle A Step By Step Guide Community Tax

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Local Tax Abatement In Ohio A Flash Of Transparency

/ScreenShot2021-02-09at11.45.57AM-685a3de0020a41b7a4b15d2226d2a93b.png)